Understanding Bit Stock: A Comprehensive Guide

Bit stock, a term that has gained significant traction in the financial world, refers to a type of investment that revolves around digital currencies. As you delve into this exciting realm, it’s crucial to understand the nuances and intricacies of bit stock. This article aims to provide you with a detailed overview, covering various aspects such as its definition, benefits, risks, and the best practices for investing in it.

What is Bit Stock?

Bit stock, also known as cryptocurrency, is a digital or virtual currency that uses cryptography for security. Unlike traditional fiat currencies, bit stock operates independently of a central authority, such as a government or financial institution. It relies on a decentralized network of computers, known as the blockchain, to record and verify transactions.

Benefits of Bit Stock

Investing in bit stock offers several advantages. Here are some of the key benefits:

| Benefits | Description |

|---|---|

| Decentralization | Bit stock operates independently of a central authority, ensuring transparency and reducing the risk of manipulation. |

| Security | Transactions are secured using advanced cryptographic techniques, making it nearly impossible to hack. |

| Accessibility | Bit stock can be accessed from anywhere in the world, as long as you have an internet connection. |

| Privacy | Transactions are pseudonymous, meaning your identity is protected. |

| Low transaction fees | Bit stock transactions often have lower fees compared to traditional banking systems. |

Risks of Bit Stock

While bit stock offers numerous benefits, it’s essential to be aware of the risks involved:

| Risks | Description |

|---|---|

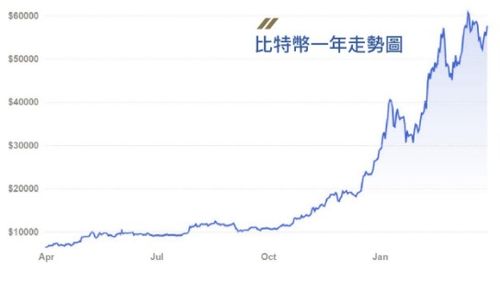

| Volatility | Bit stock prices can be highly volatile, leading to significant gains or losses in a short period. |

| Regulatory uncertainty | The regulatory landscape for bit stock is still evolving, which can lead to legal and operational challenges. |

| Lack of consumer protection | Bit stock exchanges and wallets are not subject to the same level of regulation as traditional financial institutions, which can leave investors vulnerable to fraud and theft. |

| Market manipulation |

Best Practices for Investing in Bit Stock

As you consider investing in bit stock, here are some best practices to keep in mind:

-

Do your research: Familiarize yourself with the different types of bit stock, their market capitalization, and their potential for growth.

-

Understand the risks: Be aware of the volatility and regulatory uncertainty associated with bit stock.

-

Start small: Begin with a small investment to gauge your risk tolerance and gain experience.

-

Use a secure wallet: Store your bit stock in a secure wallet to protect against theft and loss.

-

Stay informed: Keep up with the latest news and developments in the bit stock market to make informed decisions.

Conclusion

Bit stock presents a unique opportunity for investors looking to diversify their portfolios and capitalize on the potential growth of digital currencies. By understanding the benefits, risks, and best practices for investing in bit stock, you can make informed decisions and potentially reap the rewards of this exciting asset class.