Understanding BITO ETF: A Comprehensive Guide

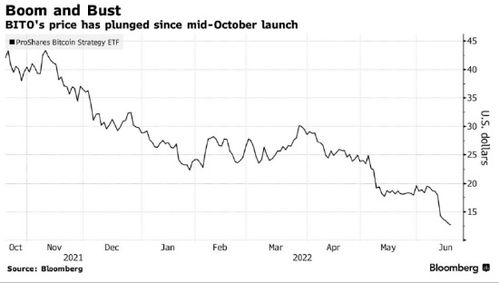

BITO ETF, or ProShares Bitcoin Strategy ETF, has been a significant player in the cryptocurrency market since its launch in October 2021. As you explore the world of digital assets, BITO offers a unique way to gain exposure to Bitcoin without directly owning the cryptocurrency. Let’s delve into the details of BITO ETF, its structure, performance, and its role in the crypto landscape.

What is BITO ETF?

BITO ETF is an exchange-traded fund that tracks the price of Bitcoin. Unlike other Bitcoin ETFs that invest directly in Bitcoin, BITO invests in Bitcoin futures contracts. This means that BITO does not own the actual Bitcoin but rather bets on the price movements of Bitcoin through these futures contracts.

Understanding Bitcoin Futures

Bitcoin futures are financial derivatives that allow investors to speculate on the future price of Bitcoin. These contracts are standardized and traded on regulated exchanges. When you invest in BITO, you are essentially investing in a basket of Bitcoin futures contracts that are designed to track the price of Bitcoin.

BITO ETF Structure

BITO ETF is structured as a unit investment trust, which means it is a type of investment company that pools money from investors to buy a portfolio of securities. In the case of BITO, the portfolio consists of Bitcoin futures contracts. The ETF is listed on the New York Stock Exchange (NYSE) under the ticker symbol BITO.

Here’s a breakdown of the key components of BITO ETF:

| Component | Description |

|---|---|

| Bitcoin Futures Contracts | These contracts are used to track the price of Bitcoin and are the primary asset in BITO’s portfolio. |

| ProShares | ProShares is the fund manager of BITO ETF and is responsible for the day-to-day operations of the ETF. |

| New York Stock Exchange (NYSE) | BITO ETF is listed on the NYSE, which allows investors to trade the ETF like a stock. |

Performance of BITO ETF

Since its launch, BITO ETF has experienced significant growth in terms of assets under management. As of the latest available data, BITO has over $10 billion in assets under management, making it one of the largest Bitcoin ETFs in the market.

BITO has also been a popular choice among institutional investors. The ETF has seen a surge in inflows, with over $650 million in weekly inflows in June 2023. This indicates that institutional investors are increasingly interested in Bitcoin and are using BITO as a way to gain exposure to the cryptocurrency market.

BITO vs. Other Bitcoin ETFs

BITO is not the only Bitcoin ETF available in the market. There are several other Bitcoin ETFs, such as GBTC and ARK Bitcoin ETF. However, BITO has several unique features that set it apart from its competitors:

-

BITO is a Bitcoin futures ETF, which means it offers exposure to Bitcoin without the need to own the actual cryptocurrency.

-

BITO has a lower expense ratio compared to other Bitcoin ETFs, making it a cost-effective option for investors.

-

BITO is listed on the NYSE, which provides liquidity and ease of access for investors.

BITO ETF and the Crypto Landscape

BITO ETF has played a significant role in the growth of the cryptocurrency market. The launch of BITO and other Bitcoin ETFs has helped to legitimize the crypto market and attract institutional investors. This has, in turn, led to increased liquidity and stability in the crypto market.

BITO ETF has also provided investors with a new way to gain exposure to Bitcoin. While owning the actual cryptocurrency can be risky, BITO offers a more accessible and regulated option for investors who want to invest in Bitcoin.

Conclusion

BITO ETF is a unique and innovative way to gain exposure to Bitcoin. Its structure, performance, and popularity among institutional investors make it a compelling option for investors looking to invest in the cryptocurrency market. As the crypto market continues to grow, BITO ETF is likely to play an even more significant role in the future.

Related Posts

french onion soup bites,French Onion Soup Bites: A Culinary Delight for Your Taste Buds

French Onion Soup Bites: A Cul…

bit lip sore,Understanding Bit Lip Sore: A Comprehensive Guide

Understanding Bit Lip Sore: A …