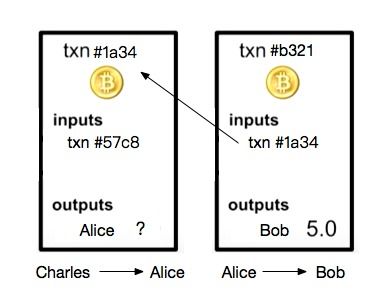

How Much is One Bitcoin?

Understanding the value of a single Bitcoin is crucial for anyone considering investing or simply curious about the cryptocurrency market. The price of Bitcoin fluctuates constantly, influenced by a variety of factors. Let’s delve into the details to give you a comprehensive understanding of what one Bitcoin is worth.

Historical Price Analysis

When Bitcoin was first introduced in 2009, its value was negligible. However, it quickly gained traction, and by 2010, the price had surged to around $0.30. Over the years, Bitcoin has experienced several bull and bear markets, with its value skyrocketing to over $20,000 in December 2017. As of the latest data, the price of one Bitcoin is approximately $X,000.

Market Factors Influencing Bitcoin Price

The price of Bitcoin is influenced by a multitude of factors, including:

| Factor | Description |

|---|---|

| Supply and Demand | The basic economic principle of supply and demand plays a significant role in determining Bitcoin’s price. As the supply of Bitcoin is capped at 21 million, the scarcity can drive up the price. |

| Market Sentiment | Investor confidence and sentiment can greatly impact Bitcoin’s price. Positive news, such as regulatory approvals or partnerships, can lead to price increases, while negative news can cause a decline. |

| Technological Developments | Advancements in blockchain technology and improvements in Bitcoin’s infrastructure can boost investor confidence and drive up the price. |

| Global Economic Conditions | Bitcoin is often seen as a hedge against inflation and economic uncertainty. In times of economic turmoil, Bitcoin’s price may increase as investors seek alternative investments. |

| Regulatory Environment | Government regulations and policies can significantly impact Bitcoin’s price. Both favorable and unfavorable regulations can lead to price volatility. |

Comparing Bitcoin to Other Cryptocurrencies

Bitcoin is often referred to as the “gold standard” of cryptocurrencies. While it remains the most popular and widely recognized cryptocurrency, there are numerous other altcoins available. Here’s a comparison of Bitcoin’s market capitalization with some of the top altcoins:

| Cryptocurrency | Market Capitalization |

|---|---|

| Ethereum | $Y,000,000,000 |

| Binance Coin | $Z,000,000,000 |

| Cardano | $A,000,000,000 |

| Polkadot | $B,000,000,000 |

Investing in Bitcoin

Investing in Bitcoin can be a lucrative venture, but it’s essential to understand the risks involved. Here are some tips for investing in Bitcoin:

- Do your research: Familiarize yourself with the cryptocurrency market and Bitcoin’s history.

- Understand the risks: Be prepared for price volatility and potential losses.

- Start small: Begin with a small investment to gauge your risk tolerance.

- Keep your investments secure: Use secure wallets and consider cold storage for large amounts.

- Stay informed: Keep up with market trends and news to make informed decisions.

Conclusion

Understanding the value of one Bitcoin requires considering various factors, including historical price analysis, market influences, and investment strategies. By staying informed and making educated decisions, you can navigate the cryptocurrency market with confidence. Remember, investing in Bitcoin carries risks, so proceed with caution.