Understanding the Bitcoin Chart: A Detailed Guide for You

When it comes to cryptocurrencies, Bitcoin is often the first name that comes to mind. Its chart, a visual representation of its price over time, is a critical tool for understanding the market. In this article, we will delve into the various aspects of the Bitcoin chart, providing you with a comprehensive guide to interpreting its data.

What is a Bitcoin Chart?

A Bitcoin chart is a graphical representation of the price of Bitcoin over a specific period. It typically includes a timeline on the horizontal axis and the price on the vertical axis. By analyzing this chart, you can gain insights into the market’s trends, patterns, and potential future movements.

Understanding the Components of a Bitcoin Chart

Let’s break down the key components of a Bitcoin chart to help you better understand its structure and how to interpret it.

Time Frame

The time frame of a Bitcoin chart refers to the duration over which the data is displayed. Common time frames include 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, 4-hour, 1-day, 1-week, and 1-month. The choice of time frame depends on your trading strategy and the level of detail you require.

Price

The price is the most crucial element of a Bitcoin chart. It represents the value of Bitcoin at a specific point in time. The price is typically displayed as a line or a series of bars, depending on the chart type.

Volume

Volume refers to the number of Bitcoin transactions that occurred within a given time frame. It is often displayed as a bar or a histogram on the chart. Higher volume indicates increased interest in Bitcoin, while lower volume suggests a lack of interest.

Open, High, Low, and Close (OHLC)

The OHLC values represent the opening, highest, lowest, and closing prices of Bitcoin within a specific time frame. These values are essential for identifying trends and patterns in the market.

Interpreting the Bitcoin Chart

Now that you understand the components of a Bitcoin chart, let’s explore how to interpret its data.

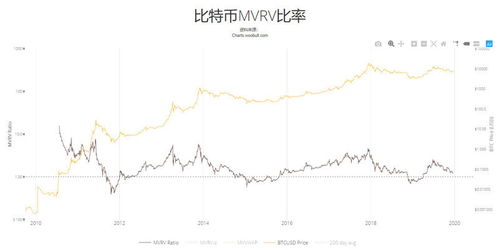

Trends

Identifying trends is one of the most important aspects of analyzing a Bitcoin chart. Trends can be classified as upward (bullish), downward (bearish), or sideways (sideways). To determine the trend, you can look at the overall direction of the price line or bars over a specific time frame.

Support and Resistance

Support and resistance levels are critical price points where the market has repeatedly shown buying or selling interest. Support levels are where the price has found difficulty falling, while resistance levels are where the price has struggled to rise. These levels can be used to predict future price movements.

Patterns

Patterns are recurring formations on a Bitcoin chart that can indicate potential future price movements. Common patterns include head and shoulders, triangles, flags, and wedges. Recognizing these patterns can help you make more informed trading decisions.

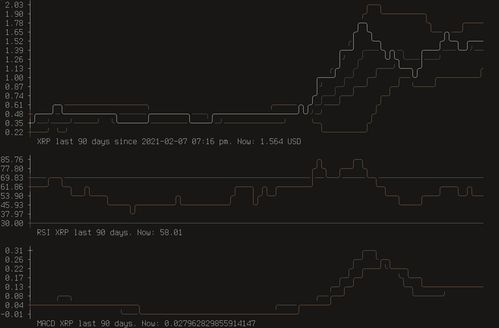

Using Technical Indicators

Technical indicators are mathematical tools used to analyze historical price and volume data to identify patterns, trends, and potential future movements. Some popular technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Moving Averages

Moving averages are a popular technical indicator that smooths out price data over a specific time frame. They can help identify trends and provide buy and sell signals.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market.

Bollinger Bands

Bollinger Bands consist of a middle band, an upper band, and a lower band. The middle band is a moving average, while the upper and lower bands are standard deviations away from the middle band. Bollinger Bands can help identify potential overbought or oversold conditions and provide buy and sell signals.

Conclusion

Understanding the Bitcoin chart is essential for anyone interested in trading or investing in Bitcoin. By analyzing its components, trends, support and resistance levels, patterns, and technical indicators, you can gain valuable insights into the market and make more informed decisions. Remember, the key to successful trading is patience, discipline, and continuous learning.