Understanding Bitcoin Futures: A Comprehensive Guide for You

Bitcoin, the world’s first decentralized cryptocurrency, has revolutionized the financial landscape. As its popularity surged, so did the need for more sophisticated trading instruments. Enter Bitcoin futures, a financial derivative that allows you to speculate on the price of Bitcoin without owning the actual cryptocurrency. In this article, we’ll delve into the intricacies of Bitcoin futures, providing you with a comprehensive guide to help you navigate this exciting market.

What are Bitcoin Futures?

Bitcoin futures are a type of financial contract that allows you to bet on the future price of Bitcoin. These contracts are standardized and traded on regulated exchanges. When you buy a Bitcoin futures contract, you’re essentially entering into a legally binding agreement to buy or sell Bitcoin at a predetermined price and date in the future.

How Do Bitcoin Futures Work?

Bitcoin futures operate similarly to traditional stock or commodity futures. Here’s a step-by-step breakdown of how they work:

-

Choose a regulated exchange: To trade Bitcoin futures, you’ll need to open an account with a regulated exchange that offers this service, such as the Chicago Mercantile Exchange (CME) or the Chicago Board Options Exchange (CBOE).

-

Deposit margin: Before you can start trading, you’ll need to deposit margin, which is a percentage of the total contract value. This margin serves as collateral and ensures that you can meet your obligations if the market moves against you.

-

Choose a contract: Bitcoin futures contracts have different expiration dates and contract sizes. You’ll need to select the one that best suits your trading strategy.

-

Buy or sell: Decide whether you think the price of Bitcoin will rise or fall. If you believe it will increase, you’ll buy a futures contract; if you think it will decrease, you’ll sell a contract.

-

Close your position: Once the contract expires, you can either take delivery of the Bitcoin or sell the contract at its current market price. If you’re trading on margin, you may need to close your position before the contract expires to avoid a margin call.

Benefits of Trading Bitcoin Futures

Trading Bitcoin futures offers several advantages:

-

Leverage: Bitcoin futures allow you to control a large amount of Bitcoin with a relatively small amount of capital. This can amplify your gains, but it also increases your risk.

-

Regulation: Trading Bitcoin futures on regulated exchanges provides a level of security and transparency that may not be available when trading over-the-counter (OTC) markets.

-

Diversification: Bitcoin futures can be a valuable addition to your investment portfolio, allowing you to gain exposure to the cryptocurrency market without owning the actual Bitcoin.

Risks of Trading Bitcoin Futures

While Bitcoin futures offer numerous benefits, they also come with significant risks:

-

Leverage: The same leverage that can amplify your gains can also lead to substantial losses. Be sure to understand the risks before trading on margin.

-

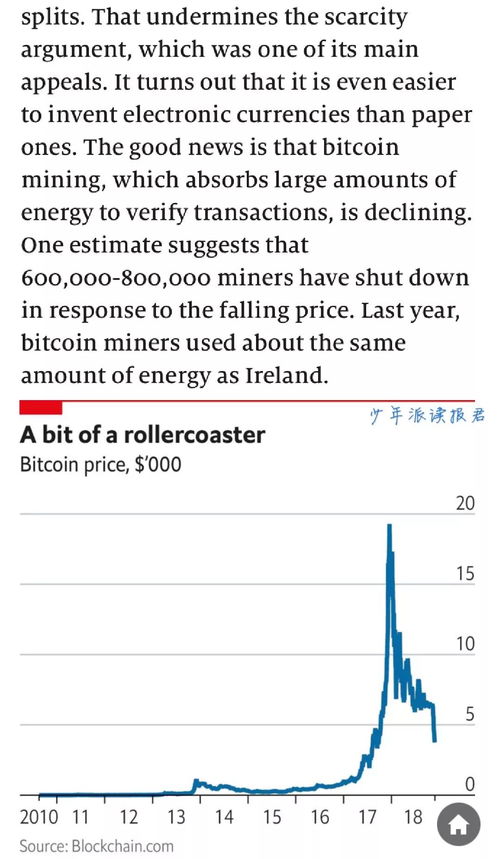

Market volatility: The cryptocurrency market is known for its extreme volatility. This can lead to rapid price swings, both up and down, which can result in significant losses.

-

Regulatory changes: The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations could impact the availability and legality of Bitcoin futures trading.

Choosing a Bitcoin Futures Broker

When selecting a Bitcoin futures broker, consider the following factors:

-

Regulation: Choose a broker that is regulated by a reputable financial authority, such as the U.S. Commodity Futures Trading Commission (CFTC) or the Financial Conduct Authority (FCA) in the UK.

-

Commissions and fees: Compare the fees charged by different brokers, including commissions, funding rates, and margin requirements.

-

Platform and tools: Look for a broker that offers a user-friendly platform with advanced trading tools and resources.

-

Customer support: Choose a broker with responsive and knowledgeable customer support to assist you with any questions or issues.

Conclusion

Bitcoin futures offer a unique way to gain exposure to the cryptocurrency market without owning the actual Bitcoin. By understanding how they work, the benefits