Understanding Bitly/ADP Tax Form

Are you looking to streamline your tax filing process? If so, you might have come across the term “bitly/adp tax form.” This article will delve into what this form is, how it works, and why it’s beneficial for both employers and employees.

What is Bitly/ADP Tax Form?

The Bitly/ADP Tax Form is a document that facilitates the electronic transmission of tax information between employers and the IRS. It is a collaboration between Bitly, a URL shortening service, and ADP, a leading provider of human resources, payroll, tax, and benefits administration solutions.

How Does the Bitly/ADP Tax Form Work?

When you use the Bitly/ADP Tax Form, you can expect a seamless process that includes the following steps:

-

Employers provide their employees with a unique Bitly link, which contains their tax information.

-

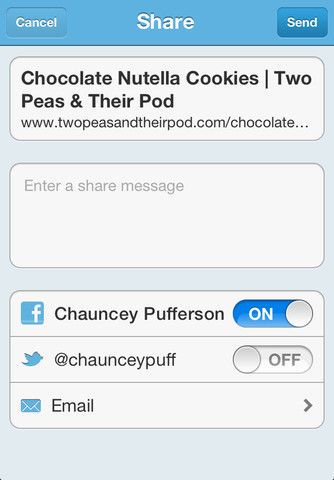

Employees click on the link and are directed to a secure ADP website where they can access and review their tax information.

-

Employees can then submit their tax information directly to the IRS through the ADP website.

Benefits of Using the Bitly/ADP Tax Form

There are several advantages to using the Bitly/ADP Tax Form:

-

Time Efficiency: The form eliminates the need for paper-based tax submissions, saving both employers and employees time.

-

Accuracy: By automating the process, the likelihood of errors is significantly reduced.

-

Security: The form uses secure encryption to protect sensitive tax information.

-

Accessibility: Employees can access their tax information from anywhere, at any time, as long as they have an internet connection.

How to Access the Bitly/ADP Tax Form

Accessing the Bitly/ADP Tax Form is straightforward:

-

Ask your employer for the unique Bitly link.

-

Click on the link and follow the instructions provided.

-

Enter your tax information and submit it to the IRS.

Understanding the Tax Information on the Form

The Bitly/ADP Tax Form contains essential tax information, such as:

-

Wages and salaries earned during the tax year

-

Employer contributions to retirement plans

-

Employer-provided benefits, such as health insurance

-

Withholdings for federal, state, and local taxes

Table: Bitly/ADP Tax Form Information

| Information | Description |

|---|---|

| Wages and Salaries | Total amount earned during the tax year |

| Retirement Plan Contributions | Amount contributed by the employer to the employee’s retirement plan |

| Benefits | Value of employer-provided benefits, such as health insurance |

| Withholdings | Amounts withheld for federal, state, and local taxes |

Why Choose the Bitly/ADP Tax Form?

Choosing the Bitly/ADP Tax Form over traditional paper-based tax submissions offers numerous benefits. Here are a few reasons why you should consider using this form:

-

Convenience: The form is easy to use and accessible from anywhere.

-

Accuracy: The automated process reduces the risk of errors.

-

Security: Your tax information is protected using secure encryption.

-

<