How Much Does a Bitcoin Cost?

Understanding the cost of Bitcoin involves considering various factors that can influence its price. Whether you’re a beginner looking to invest or an experienced trader, it’s crucial to have a comprehensive understanding of what affects the value of Bitcoin. Let’s delve into the details.

Market Dynamics

The price of Bitcoin is determined by the supply and demand in the market. When demand for Bitcoin increases, its price tends to rise, and vice versa. This dynamic is similar to other commodities and financial assets. However, Bitcoin’s market is relatively new and volatile, making it more unpredictable than traditional markets.

Several factors can influence the demand for Bitcoin, including regulatory news, technological advancements, and macroeconomic trends. For instance, if a country announces strict regulations on cryptocurrencies, it may lead to a decrease in demand and, consequently, a drop in price. Conversely, positive news about Bitcoin’s adoption or technological breakthroughs can drive up its value.

Market Capitalization

Market capitalization is another crucial factor to consider when determining the cost of Bitcoin. It represents the total value of all Bitcoin in circulation. As of my last update, the market capitalization of Bitcoin was around $500 billion. This figure can fluctuate significantly based on market conditions.

Market capitalization is calculated by multiplying the current price of Bitcoin by the total number of coins in circulation. It’s important to note that the supply of Bitcoin is capped at 21 million coins, which makes it a deflationary asset. This scarcity can contribute to its value over time, especially if demand continues to grow.

Transaction Fees

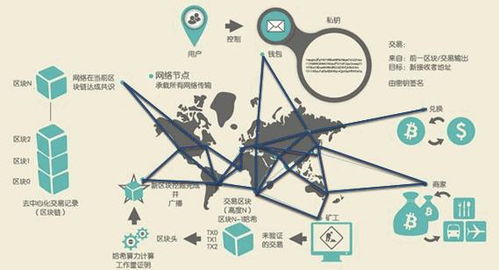

When you buy or sell Bitcoin, you’ll need to pay transaction fees. These fees are paid to miners who validate and process your transactions on the blockchain. The amount of transaction fees can vary depending on the network congestion and the size of your transaction.

During periods of high network congestion, such as when Bitcoin is experiencing a surge in popularity, transaction fees can become quite expensive. However, during less busy times, fees can be relatively low. It’s essential to keep this in mind when budgeting for your Bitcoin purchases.

Exchanges and Brokers

The cost of Bitcoin can also be influenced by the platform you choose to buy or sell it. Different exchanges and brokers have varying fees, including transaction fees, deposit fees, and withdrawal fees. It’s crucial to research and compare these fees before deciding on a platform.

Some popular Bitcoin exchanges include Coinbase, Binance, and Kraken. Each platform has its own set of fees and features, so it’s essential to choose one that aligns with your needs and preferences. Additionally, some brokers offer margin trading or other advanced trading options, which can come with higher fees and risks.

Historical Price Data

Looking at historical price data can provide valuable insights into the cost of Bitcoin. Over the years, Bitcoin has experienced significant price volatility, with periods of rapid growth followed by corrections. Understanding this volatility can help you make more informed decisions when buying or selling Bitcoin.

For example, Bitcoin reached an all-time high of nearly $20,000 in December 2017, only to plummet to around $3,000 by February 2018. Since then, it has experienced several bull and bear markets, with its value fluctuating widely. By analyzing this data, you can gain a better understanding of Bitcoin’s price trends and potential future movements.

Conclusion

Understanding the cost of Bitcoin involves considering various factors, including market dynamics, market capitalization, transaction fees, exchanges and brokers, and historical price data. By taking these factors into account, you can make more informed decisions when buying or selling Bitcoin. Remember that the cryptocurrency market is highly volatile, so it’s essential to stay informed and adapt your strategy accordingly.